Flood Zones & Insurance

3. Is the property in a flood zone according to FEMA maps?

With the increased frequency and severity of storms and ongoing sea-level rise, coastal properties are often at higher risk for damage caused by flooding events. As such, proximity to the coast can have a number of impacts on a coastal property, from additional flood insurance premiums to special building requirements.

As part of the National Flood Insurance Program, the Federal Emergency Management Agency, or FEMA, has mapped risk zones for flood-prone areas, and these maps inform flood insurance rates as well as municipal and state regulations. The most recent Flood Insurance Rate Maps, or FIRMs, can be found at the FEMA Map Service Center.

Why it matters: If a structure is in a high-risk flood hazard zone (or a Special Flood Hazard Area) as determined by FEMA, a buyer must obtain flood insurance in order to get a mortgage. For owners of existing structures within flood zones, taking out a line of credit, obtaining a reverse mortgage, or acquiring any federally-attached loan will require the borrower to purchase flood insurance. For property owners looking to build, any structure built in a SFHA will require flood insurance if a mortgage is needed, and new construction will have to meet the latest building codes.

To find out if the property is in a flood zone: Consult the Flood Insurance Rate Maps (FIRMs) for the municipality. These are located at the city or town hall, but can also be found online at the FEMA Map Service Center. Additionally, FIRM information is available on the R.I. Emergency Management Agency (RIEMA) flood mapping page, and through the RIEMA Floodplain Mapping tool. The RIEMA Floodplain Mapping tool is intended to be used for reference only, and will direct the user to the official FIRMs. The tool comes with a helpful tutorial that explains the maps, the different flood zones, and how to get more information about a specific property.

If the property is not currently in a flood zone, be sure to check the 0.2% risk area (or 500-year flood zone) to see if the property may be in the flood zone in the future. With rising sea levels, the 0.2% risk area may offer a more accurate look at the future floodplain. Additionally, many lenders assess flood-risk for the life of the loan, and with increasing sea-level rise and shoreline change, the long-term impacts on the property may come into play.

Consulting the Maps

- Base flood – the flood having a 1% chance of being equaled in any given year, also known as the “100-year-flood” – this is used as a national standard

- Base flood elevation (BFE) – the computed elevation for which floodwater is anticipated to rise during base flood

- Elevation certificate (EC) – a FEMA document filled out by a professional which verifies the elevation of the lowest floor of a building (necessary for obtaining insurance and other information)

- FIRM – Flood Insurance Rate Map

- Flood insurance premiums – the relationship between the BFE and a structure’s elevation determines the flood insurance premium

- Floodplain – the area inundated by the base flood

- Flood Zones – 0.2 Percent Annual Chance Flood Zone, A-zone, AE-zone, AH-zone, AO-zone, VE-zone (see the flood zone descriptions on the next page)

- Lowest floor – the lowest enclosed area of the structure, including the basement

- Map panel – corresponds to FIRMs, refers to specific sections of the map

- NFIP – National Flood Insurance Program

- SFHA – Special Flood Hazard Area

Using the RIEMA Floodplain Mapping Tool

Please note that the RIEMA Floodplain Mapping tool is intended to be used for reference only, and will direct the user to the official FIRMs. The RIEMA mapping tool is based on the FEMA flood insurance maps, and displays all of the FEMA flood zones. See the explanation of the flood zones, from the RIEMA Map Tool Tutorial below.

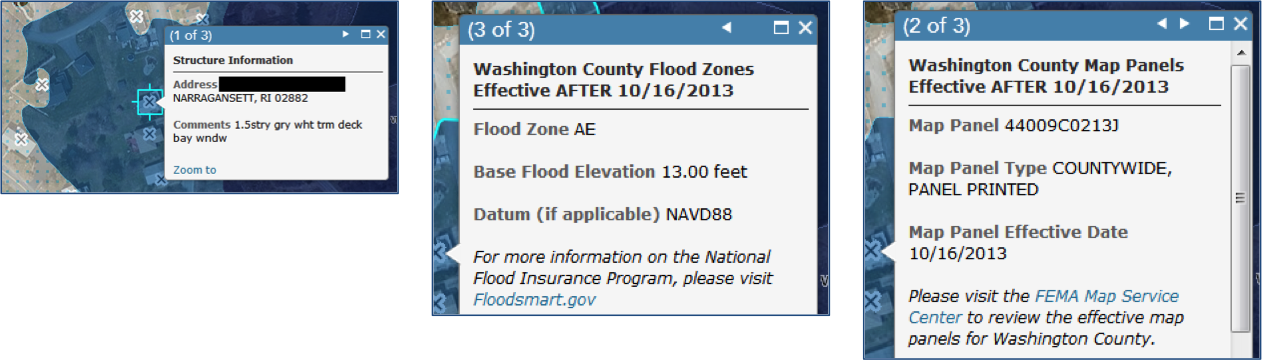

After an address is entered, the mapping tool provides the FIRM Map panel for the property, and, if the structure is within the SFHA, the flood zone classification, and the BFE (see below).

View the PDF: Using the RIEMA Floodplain Mapping Tool

View the PDF: Using the RIEMA Floodplain Mapping Tool

4. If I am in a flood zone, do I have to obtain flood insurance? How can I find out what my flood insurance premiums will be?

4. If I am in a flood zone, do I have to obtain flood insurance? How can I find out what my flood insurance premiums will be?

Homeowner’s insurance does not cover damage caused by coastal flooding – flood insurance in the coastal zone must be purchased separately. As part of the National Flood Insurance Program (NFIP), the federal government offers flood insurance to homeowners everywhere, including those within the coastal floodplain.

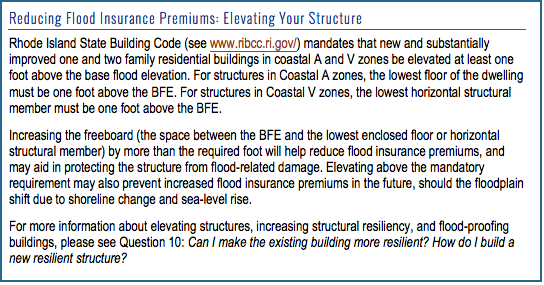

Why it matters: If a structure is in a high-risk flood hazard zone as determined by FEMA, a buyer must obtain flood insurance in order to get a mortgage. For existing structures or buildings within flood zones, an owner taking out a line of credit, obtaining a reverse mortgage, or acquiring any federally-attached loan will need to purchase flood insurance. Property owners intending to build in a flood zone will be required to purchase flood insurance if they are obtaining a mortgage. Additionally, all new construction must meet the most recent building codes.

If a property is only partially in a flood zone, structures that are not within the flood zone do not require flood insurance.

To determine if your property is within a flood zone, and to obtain information about structures on the property, visit the FEMA Map Service Center or the RIEMA floodplain mapping page.

Image from the RIEMA Floodplain Mapping Tool. The structure on the left would not have a mandatory flood insurance requirement, while the structure to the right is entirely within the AE Zone and would require a borrower to purchase flood insurance.

Getting a Flood Insurance Estimate

In order to get a flood insurance estimate, an owner must obtain an elevation certificate for any post-FIRM structure (a building constructed or substantially improved after the adoption of the first flood insurance rate maps). An elevation certificate is an official FEMA document filled out by an authorized land surveyor, engineer, or architect verifying the elevation of the lowest floor (see below) of the structure. Elevation certificates are used to determine the appropriate flood insurance premium rate for the building, and also attest to a community’s compliance with floodplain management ordinances.

The lowest floor of a structure is the lowest floor of the lowest enclosed area of a structure, including the structure’s basement. Areas that are not fully enclosed or are flood-resistant (frequently areas used for storage, parking, or access) are not considered the lowest floor.

Once the elevation certificate is verified, an insurance company can provide estimates for future flood insurance premium rates. Due to recent changes in the NFIP, relying on a property seller’s premiums and other insurance information to estimate potential premium is not recommended.

Flood Insurance Claims & Past Damage

FEMA flood insurance claim information is not accessible to the public. However, FEMA provides statistics on claims by state and municipality. The loss statistics for Rhode Island are located in FEMA’s NFIP statistics report.

If you are purchasing a property with existing buildings, ask the seller or real estate licensee about the property’s history of flood damage – it is the seller’s responsibility to disclose any known defects to prospective buyers. You can also contact the municipality’s building official to get information on any permits that were required or issued to the previous owners documenting any repairs or renovations to the building.

NFIP Community Rating System

The Community Rating System (CRS) is a voluntary program through which communities can earn discounts off premiums for flood insurance policy holders by exceeding NFIP floodplain management requirements. If you are purchasing flood insurance, visit the RIEMA Floodplain Management page to see if your community participates in the program. It is the responsibility of the property owner to notify his or her insurance agent of a community’s participation in the program.

Find out more: For more information about the floodplain, flood insurance, and the Community Rating System, visit the RIEMA’s Flood Insurance page, consult the Floodplain Management in Rhode Island: 2007 Quick Guide, or contact your local NFIP Coordinator. For additional insurance information, please see the R.I. Department of Business Regulation Insurance Division’s Consumer Alert: HURRICANE PREPARATION: Act Now to Make Filing a Claim Easier After the Storm.

NEXT: Erosion, Sea-Level Rise, & Shoreline Protection >>

This website has been prepared by the University of Rhode Island’s Coastal Resources Center and Rhode Island Sea Grant for the R.I. Coastal Resources Management Council as a guidance resource. It is not intended nor should be used to give any legal advice nor to supersede any state or federal statutory or regulatory language or interpretation of such language. This website refers the reader to various regulations and policies adopted by federal and state regulatory agencies; the reader is encouraged to review the specific regulation and policy.

Rhode Island Coastal Property Guide Credits & Acknowledgements